collaborating to support sme housebuilders.

Following a highly successful pilot scheme, we are delighted to have formally joined forces with innovative market specialists, LDS, to promote their unique Sales Guarantee scheme. We believe the benefits of this scheme, when combined with a bespoke Pivot development loan, are compelling, not just for SME housing developers but also for you, our key broker partners.

Available throughout England and Wales on housing schemes of typically 10-30 houses, we can help you to maximise conversion rates whilst simultaneously boosting your fee income.

How exactly can you, as a broker, benefit?

LDS fees will be paid to you on top of your Pivot proc fee.

Increased leverage and reduced equity contributions will lead to better conversion rates.

A joint LDS/Pivot mailbox for enquiries will ensure we work concurrently on all cases you submit and provide the fastest possible turnaround times.

A simpler alternative to mezzanine finance on certain cases with no security taken by LDS.

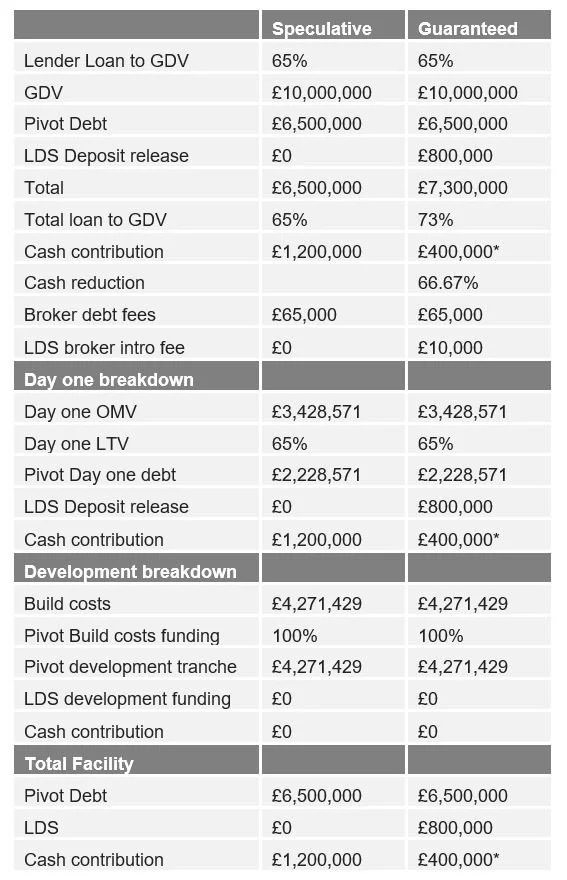

By reducing your clients’ equity contribution and in turn increasing their returns, an LDS Guarantee powered by a Pivot development facility can be a real game-changer. In difficult market conditions, with spiralling material and labour costs, the additional certainty this partnership offers your SME developer clients is both valuable and timely.

How exactly does an LDS Guarantee with a bespoke Pivot senior loan transform the viability of your developer clients’ schemes?

1. Availability – the joint offering is available where:

It is a housing scheme (not apartments);

It is in a liquid area (typically sales values are not in the top 10%);

It is in England or Wales;

There are a minimum of 10 units being built and a maximum of 30;*

GDV is greater than £3m;

Developer has a track record.

2. Purchase – the following contributions will be made:

LDS will provide 10% exchange funds against a 20% discounted GDV (ie 8% of GDV);

Pivot is the trading name for the Pivot group of companies). Pivot Lending Ltd is registered at Companies House Cardiff under number 10067031, registered address

3rd floor, 10-12 Bourlet Close, London, W1W 7BR.

Client will contribute 5-10% of Total Costs of the project;

Pivot will contribute the balance towards the purchase (as long as their total gross loan is less than 65% of GDV).

3. Build –

Pivot will fund 100% of all (hard) build costs (subject to the total loan being less than 65% of GDV).

4. Exit –

LDS will provide a Sales Guarantee at 80% of GDV (ie they will contract to buy the units at a 20% discount against GDV);

The client can choose to sell the units on the open market. If they are sold, LDS’ deposit is returned on sale, plus a fee (typically 3.5% of the sales price)

What does this look like in reality?

Only rarely in our market is a scheme developed where there are obvious and clear opportunities for all parties involved. Whether it’s us as a lender, you as the broker or our developer clients everyone benefits from this unique collaboration.

Successfully Tried and Tested:

After a successful pilot on an £1.85m scheme, in which Pivot and LDS partnered to fund the development of 8 new houses in Norfolk. The new loan was used to support the purchase of the site in King’s Lynn, and will fund 100% of the build costs for the product.

With speculative risks removed, Pivot was able to accept an equity contribution of just 8% of total costs from the borrower. The first charge loan was secured against the site at 65% LTGDV with a rate of 9.5% pa over a term of 18 months.

Alongside the 10% cash deposit from LDS, this has enabled the developer to progress on the site, turning a disused, formerly commercial site into eight new three- and four-bedroom homes.

In summary, if you want to minimise risk and maximise the opportunity for your clients whilst simultaneously increasing your own fee income, then please make contact today. For a rapid review of your development enquiries by the LDS and Pivot Teams:

Call us: 020 3695 5511

E-mail us: sales@pivotfinance.co.uk

Or better still send your enquiry to us both via:

enquiries@ldsandpivot.co.uk

We look forward to speaking with you.

** LDS can consider schemes up to 60 units but Pivot cap at 30 units. Schemes that do not meet these parameters will be considered by exception.